Our Foundation - Your Legacy

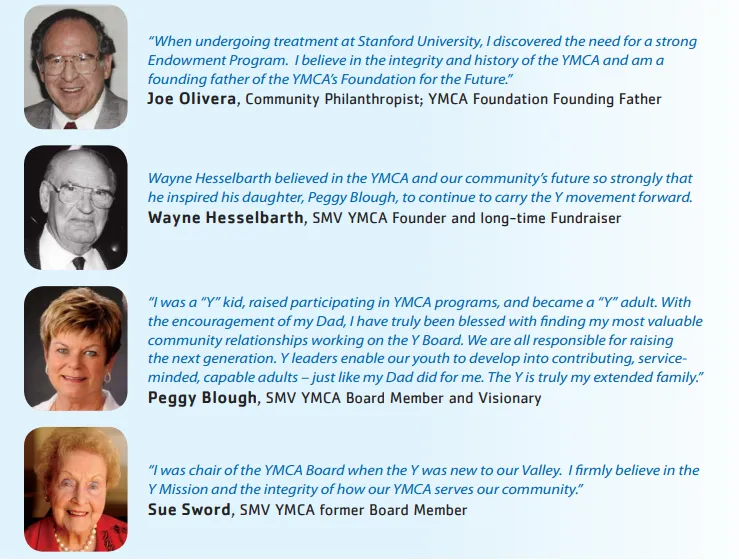

Visionaries built the Santa Maria Valley YMCA, and visionaries will assure its bright future.

When you give to the Santa Maria Valley YMCA Foundation, you, too, become a visionary who helps us further our cause.

You help us guarantee a future path to continue serving people in need and providing high-impact, life-enhancing services for families – yours, your friends’ and neighbors’, right here in our community. The nature of gifts to the Foundation may vary, depending on your circumstances and preferences. Some gifts offer tax or other estate benefits.*

*The Santa Maria Valley YMCA Foundation cannot provide legal, tax, accounting or financial advice. When considering Foundation gifts, you are encouraged to seek professional legal, tax and/or financial advice designing your contribution.

Including Santa Maria Valley YMCA in Your Will, Trust or Estate

In general, one of the simplest ways to leave a lasting legacy to the Santa Maria Valley YMCA is the bequest. Bequests in a contributor’s will or trust set aside a sum of money, portion of the estate or portion of the residual estate for distribution to a charitable organization such as the Y. Such gifts enable you to make significant contributions that may not have been possible during your lifetime. By including Santa Maria Valley YMCA in your will or living trust, you can make an important and lasting gift while meeting your financial and estate planning goals. A bequest can take many forms, and because a bequest qualifies for the estate tax charitable deduction, it may reduce your taxable estate.

General

This designates a specific sum from your estate to a charitable organization. “I give to Santa Maria Valley YMCA Foundation, a 509 (a) (3) corporation organized and existing under the California Nonprofit Corporation Law, located at 3400 Skyway Drive, Santa Maria, CA 93455, Tax ID #77-0472736, the sum of ________ dollars (or specific piece of property) to be used as the board of directors directs.”

Percentage Bequest

This provision designates a set percentage of your estate to a charitable organization. “I give and bequeath ________ percent (name specific percentage) of my estate to Santa Maria Valley YMCA Foundation, a 509 (a) (3) corporation organized and existing under the California Nonprofit Corporation Law, located at 3400 Skyway Drive, Santa Maria, CA 93455, Tax ID #77-0472736”

Residual Bequest

This is a provision in a will leaving the remainder of one’s estate to an organization after all other bequests are fulfilled. “The rest, residue and remainder of my estate, both real and personal, whatever situation, I give and bequeath to Santa Maria Valley YMCA Foundation, a 509 (a) (3) corporation organized and existing under the California Nonprofit Corporation Law, located at 3400 Skyway Drive, Santa Maria, CA 93455, Tax ID #77-0472736.”

Contingent Bequest

This leaves a bequest to Santa Maria Valley YMCA Foundation if any of the other beneficiaries are unable to receive their bequests because of death or other circumstances. Generally this reads, “should (name of person) predecease me, the portion of my estate going to _________ (this person) I give and bequeath to “Santa Maria Valley YMCA Foundation, a 509 (a) (3) corporation organized and existing under the California Nonprofit Corporation Law, located at 3400 Skyway Drive, Santa Maria, CA 93455, Tax ID #77-0472736”

Designate Santa Maria Valley YMCA as the beneficiary of your Life Insurance Policy.

We realize that if you need your life insurance for the future financial security of your family, those concerns must come first. However, if you have existing policies you no longer need for coverage, consider assigning ownership to Santa Maria Valley YMCA Foundation.

By naming Santa Maria Valley YMCA Foundation as both owner and beneficiary, you get a tax deduction while making a large difference to our mission. Paid-up existing life insurance policies are also immediately eligible for a charitable tax deduction for the cost basis or surrender value – whichever is less - in the tax year that Santa Maria Valley YMCA is named owner and beneficiary. A gift of life insurance is a simple way to give and makes a significant contribution to the future of our community.

Designate Santa Maria Valley YMCA as the beneficiary of your Retirement Plan

Do you know that your remaining retirement plan assets are facing possible double taxation? If you leave these assets to any individual other than your spouse, you will generate “income in respect of a decedent.” As a result, retirement plan assets may be significantly diminished by estate taxes and these assets are also taxed to the beneficiary(ies) as ordinary income, subject to the recipient’s income tax bracket.

Undoubtedly, your decision regarding who receives the remainder of your qualified retirement plan assets depends on your family members’ needs and circumstances; we understand that family comes first. But if you want to include the Y in your legacy charitable giving and can make alternative provisions for your family using other assets, directing your retirement plan assets to Santa Maria Valley YMCA as a charitable bequest may be a much more efficient option.

By naming Santa Maria Valley YMCA as a beneficiary of all or a portion of your retirement plan assets, you avoid both the estate tax and income tax due on these tax-deferred plans if you distribute them to your heirs.

Your gift of retirement plan assets to Santa Maria Valley YMCA makes the most of your intended charitable giving and helps us to continue our vital work. We recommend that donors consult their professional advisors before directing retirement assets.

Donate Appreciated Stock to Santa Maria Valley YMCA for a truly impactful return on your investment.

A gift of appreciated stock – now, or in the future - can avoid capital gains taxes that would be due as a result of its sale. Your tax benefit is generally the fair market value of the stock at the time of your gift. With gifts of appreciated stock, your stock market earnings translate into true impact for our mission – a very rewarding return on your investment and a simple way to give.